WHY A CLIENT IS IMPORTANT FOR YOUR BUSINESS

August 4, 2017Value is created by doing something unexpected outside the domain of your business.

August 17, 2017

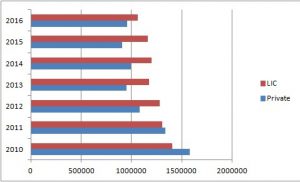

Table 1 : Agents on the rolls in the last 7 years (on 1st April of relevant year)

| AGENTS | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| Private | 1575476 | 1337064 | 1080651 | 949774 | 992584 | 904303 | 955005 |

| LIC | 1402807 | 1302328 | 1278234 | 1172983 | 1195916 | 1163604 | 1061560 |

As seen in Table 1, from a high of 29.5 Lakh agents in 2009-10 we have now reached a much reduced numbers of 20.16 lakh agents in 2015-16 a drop of 32% in a matter of 6 years. The Private Life insurance advisor numbers dropped by 39% whereas the LIC’s agents numbers dropped by 24%.

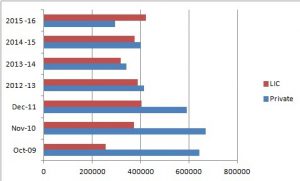

Table 2: Yearly deletions of agencies in last 7 years.

| Deletions | 2009 -10 | 2010 -11 | 2011 -12 | 2012 -13 | 2013 -14 | 2014 -15 | 2015 -16 | Total |

| Pvt | 642439 | 668615 | 589888 | 414263 | 340571 | 401949 | 295153 | 3352878 |

| LIC | 254596 | 372039 | 404747 | 387017 | 318506 | 374360 | 421472 | 2532737 |

As seen in table 2, the total Industry lost two times the number of agents on the roll in 2009-10. While the total agents on roll in 2009 -10 were 29.5 lakhs, the total industry deletions in six years amounted to 58.85 Lakhs out of which the Private Life insurance companies lost 33.52 lakhs and LIC lost 25.32 Lakh agents during the same period.

Two major fallouts of the deletions

- 85 Lakh deleted advisors must be talking negatively about the Insurance Industry and creating a negative branding for industry

- Even if we estimate that the 58.85 Lakh advisors must have just done 10 Policies before being terminated, then 5.88 Crore Policyholders have become orphaned and again had a very bad experience will again create a negative branding for the Industry

Does this augur well for the Industry ?

What do we need to do to set a corrective direction to the most important channel in the world – the agency channel. Are the private insurance companies giving up on the agency channel ?

LIC of india gets 96% of its business from the agency channel while the Private life insurance industry gets just 32% business from agency channel (IRDA report 2015-16, Page 74 channel wise distribution of insurance)

The ROOT CAUSE for these trends is because the Advisors are recruited for COMMISSION instead of recruiting for MISSION.